Why Cali Miners?

- U.S .owned, domestically registered and domiciled company is behind the business

- Our own staff and assets in Southeastern Europe operate the rigs, providing full visibility and transparency to investors

- Cali Miners is an experienced team of operators, engineers, and business people with technology sector experience dating back to 1998

- Diversified investments in two major cryptocurrencies, with an OTC trading exit strategy and ancillary opportunities in other blockchain driven technologies

- Green energy used in operation, vested in promoting sustainability

- Containerized, easily deployable production entities that are mobile, flexible, and completely self-contained

Why NOW?

- While the best time to get into certain cryptocurrencies might have been a few years ago, it’s definitely not too late to invest

- With institutional investors becoming involved, there is more interest in crypto. Many of these investors are holding their positions, putting limits on the available supply, which is likely drive prices up over time.

- The backing of some important influencers such as Elon Musk (Tesla), Bill Gates (Microsoft), Jack Dorsey (Twitter), and Ashton Kutcher (Actor/Tech Investor) have given these assets additional credibility.

- Major banking institutions are also investing into cryptocurrency including Bank of New York Mellon, Deutsche Bank, Bank of America, Chase, USAA, and PNC, among others

- ETH hit all-time high to date of $4,213.46 (May 2021)

- BTC hit all-time high to date of $64,829.14 (Apr 2021)

Solution

- Cali Miners sets up mining rigs in Southeastern Europe funded by individual tranches of investment. A single production entity consists of 20 dedicated rigs housed in mobile CONEX Containers.

- Each production entity is focused on either BTC or ETH to diversify risk, with Tranche 1 focused solely on the latter

- Location takes advantage of lower electricity rates and renewable energy sources, along with trusted long-standing relationships

- Scalable investment due to tranche approach allows individual investors to commit capital over time, if desired

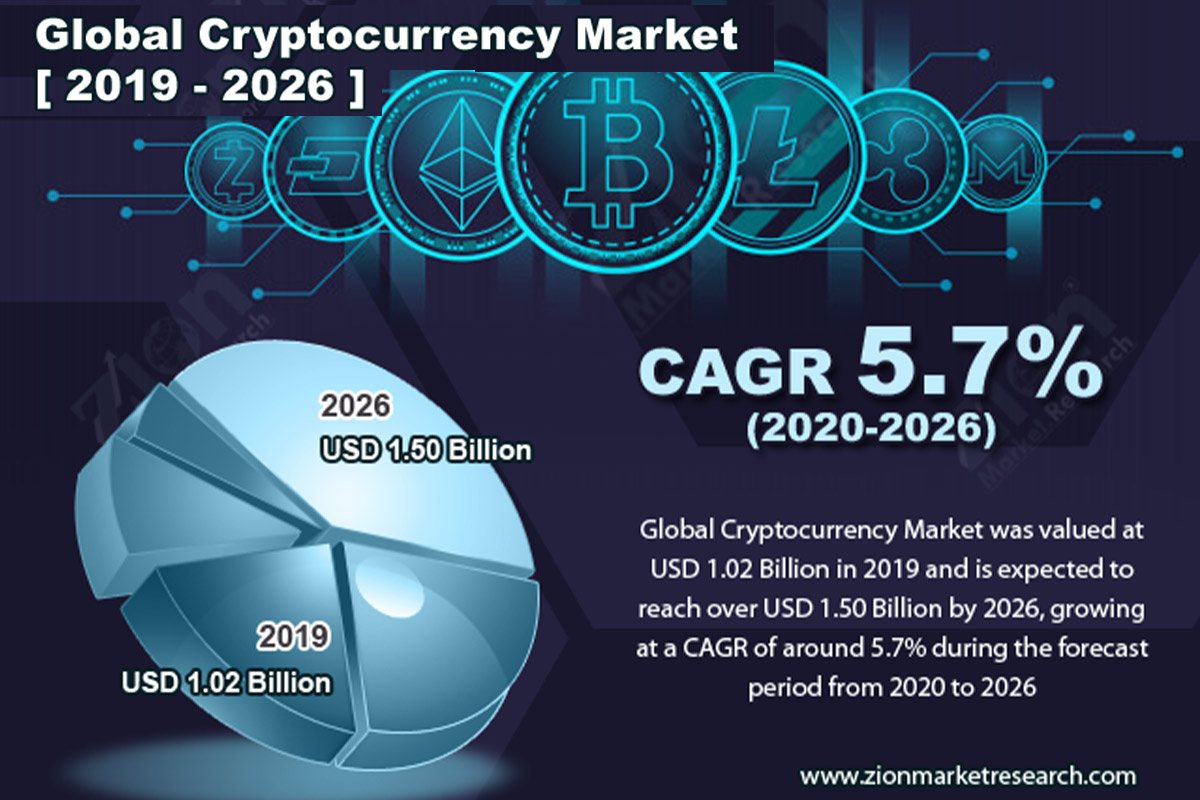

Which Cryptocurrency to Mine?

- The cryptocurrencies we think are most likely to perform over time are Bitcoin (BTC) and Etherium (ETH)

- BTC has been projected by some sources to potentially reach a valuation of $300K – $400K per coin by 2023-2024, with ETH to reach $10K per coin by 2022

- While this form of currency is starting to move more towards the mainstream, it’s still early enough to take advantage of the growing popularity and acceptance of crypto

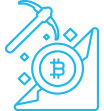

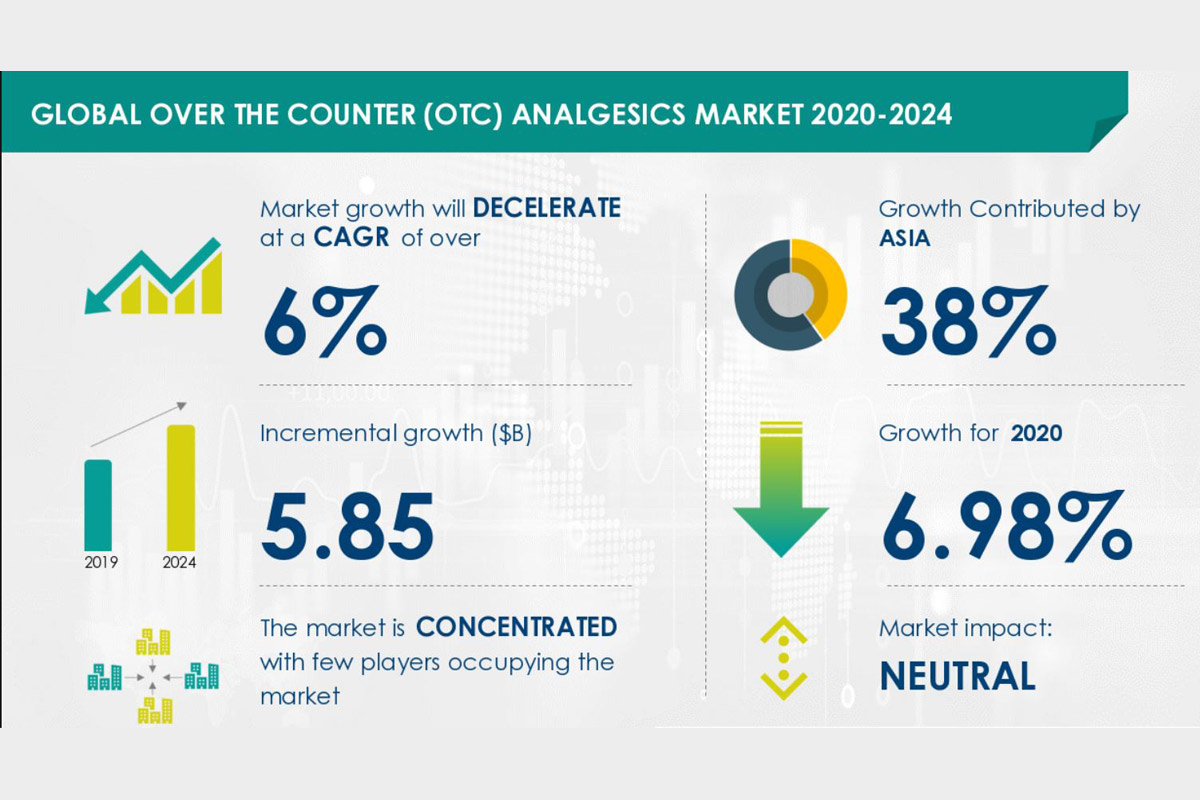

Market Size & Projected Growth

“The global Cryptocurrency Market was estimated at USD $792.53 Million in 2019 and is expected to reach USD $5,190.62 Million by 2026. The global Cryptocurrency Market is expected to grow at a compound annual growth rate (CAGR) of 30% from 2019 to 2026”

“The global cryptocurrency market size stood at USD $754.0 million in 2019 and is projected to reach USD $1,758.0 million by 2027, exhibiting a CAGR of 11.2%”

“The value of the cryptocurrency market in April 2021 actually topped $2 trillion”

Competition

-

While there are no obvious limitations on the number of companies that can mine cryptocurrency, thus translating into a wide world of competition, this doesn’t preclude the ability to compete in this field, given the increased interest and opportunity. Some relevant competitors that are OTC and NASDAQ registered (an end goal of Cali Miners) that launched with minimal capital investment are:

-

- Argo Blockchain PLC

- Galaxy Digital Holdings, Ltd.

- Bitfarms, Ltd.

- Bit Digital, Inc.

- Ebang International Holdings, Inc.

- HIVE Blockchain Technologies, Ltd.

- Marathon Digital Holdings, Inc.

- Riot Blockchain, Inc.

- SOS Limited

-

Our Product

Each investment tranche consist of a mining “production entity” comprised of 20 high-performance Ethereum GPU rigs with +120 Miners, and Bitcoin Containers of 50 Bitmain Asics S19 pro Miners.

ETH will be the cryptocurrency mined with the production entity financed by the dedicated rounds of $250K, as it has a lower cost of entry (20 rigs equates to 120 miners) and is gaining traction as a viable currency option.

BTC investment rounds usually raise $500K-$750K (to finance 50 BTC Asics miners), with the goal of adding mining capacity at the start of 2022 (Month 7 of Operations).

Over a 12-month period, the following mining yields are anticipated:

96 Ethereum coins and 14 Bitcoins based on each setup

Ancillary Revenue Opportunities

-

Cali Miners, as an ancillary revenue source, will create its own Non Fungible Tokens (NFTs) to become a dominant player in Southeastern Europe in this emerging blockchain virtual asset

Currently, NFTs are still relatively unknown in the region and there is an opportunity to position for first mover advantage

Ancillary Revenue Opportunities (Cont)

- For investors of more modest means, Cali Miners will provide the ability to lease a mining rig for a 70/30 split (majority to investor) with an upfront one-time payment

- Terms will be for a 24-month lease, after which the rig reverts to company ownership and company receives 100% of mining results

- Lessee can then opt to enter into another leasing agreement or if means and risk profile allow, can participate in future production entity opportunities

Business Model

- By placing the production in Southeastern Europe (Serbia, Greece, and Montenegro) we are benefiting from low price of electricity as a key input element in the production of cryptocurrencies. As these locations have substantial renewable energy potential (including solar), we procure electricity from certified green sources meaning our BTC and ETH mining is not harmful to the environment!

- Our team of experienced mining operators will set up the best performing rigs and begin full capacity operation within three months of the start date.

- We offer investors participation in “tranches” consisting of a series of dedicated rigs which are categorized as one production entity. There can be many entities, allowing investors to have fractional ownership of a larger investment.

- We produce cryptocurrency but do not sell it to cover operational expenses in Year One unless absolutely necessary. We hold the currency and only at the end of a period we may sell it to cover operational costs for the next year, preserving value and continuing operation. We hold the crypto that we produce, playing the longer game – Hold on for Dear Life (HODL)!

Risk Mitigation / Exit

- Mining rigs are high performance computers/servers, and are a physical asset, even with depreciation

- Over time, the value of both ETH and BTC are likely to continue to go up, given more institutional investment in cryptocurrency, wider acceptance as a form of payment (or collateral), and the fact that many investors are willing to hold coins and play the “long game”

- Cali Miners will issue shares as a California incorporated “C” corp. to investors, which will enable them to have a means to exit at a future date, with the company maintaining a right of first refusal

- The company will set thresholds for the appreciation of ETH and BTC holdings to trigger evaluations of when to liquidate coins on the market in order to provide dividends to investors and/or to re-invest into new mining operations

- The goal of Cali Miners is to reach the metrics where the company can be publicly traded on the OTC market, within three years

- The company will acquire smaller operations in the region, particularly in Serbia and Montenegro, thus adding to its mining capability